Entrance and exit

After all the checks, the investor highly assessed the startup and received a share in it. Does this mean that the investor and the founder have become rich people because they own shares of a successful company?

No, it doesn't. A startup is not a public company, its share cannot be sold on the open market, like, say, Facebook or Apple shares. To sell your share of a startup, you need to find a buyer interested in such a specific asset. Most often, such shares are bought by a new venture investor, who still needs to be interested. Large companies from the same industry can also buy back the entire startup.

In venture terminology, selling your share is called exit from a startup. Sooner or later everyone exits, employees are fed up with small salary, founders create new startups, because they need “live” money, not a package with potential millions. As for investors, they will not even go into a startup without an exit perspective. Investment funds seek to maximize the difference between the price of entry and the exit price to increase their profitability for investors.

Why agree?

Exit scenarios are provided by the agreements that startup participants make among themselves. From the mathematics standpoint, corporate governance is a huge field of non-zero-sum games. In other words, in certain situations, the participants' interest can lead the whole company to a standstill. This could turn into “Who will jump out of a falling startup” game (“prisoner's dilemma” in its pure form) or deadlock, when participants block any decision.

The solution to such situations can only be prescribed in advance in a binding agreement. Of course, something is regulated by law, such as squeezing out minority shareholders in the law on joint-stock companies, priority rights in an LLC and so on. But they don’t always work (I’ll give you an example of share exchange), therefore it is important to ensure that all pitfalls are removed. This can be done only if we allow members to negotiate the way they want.

Corporate agreement

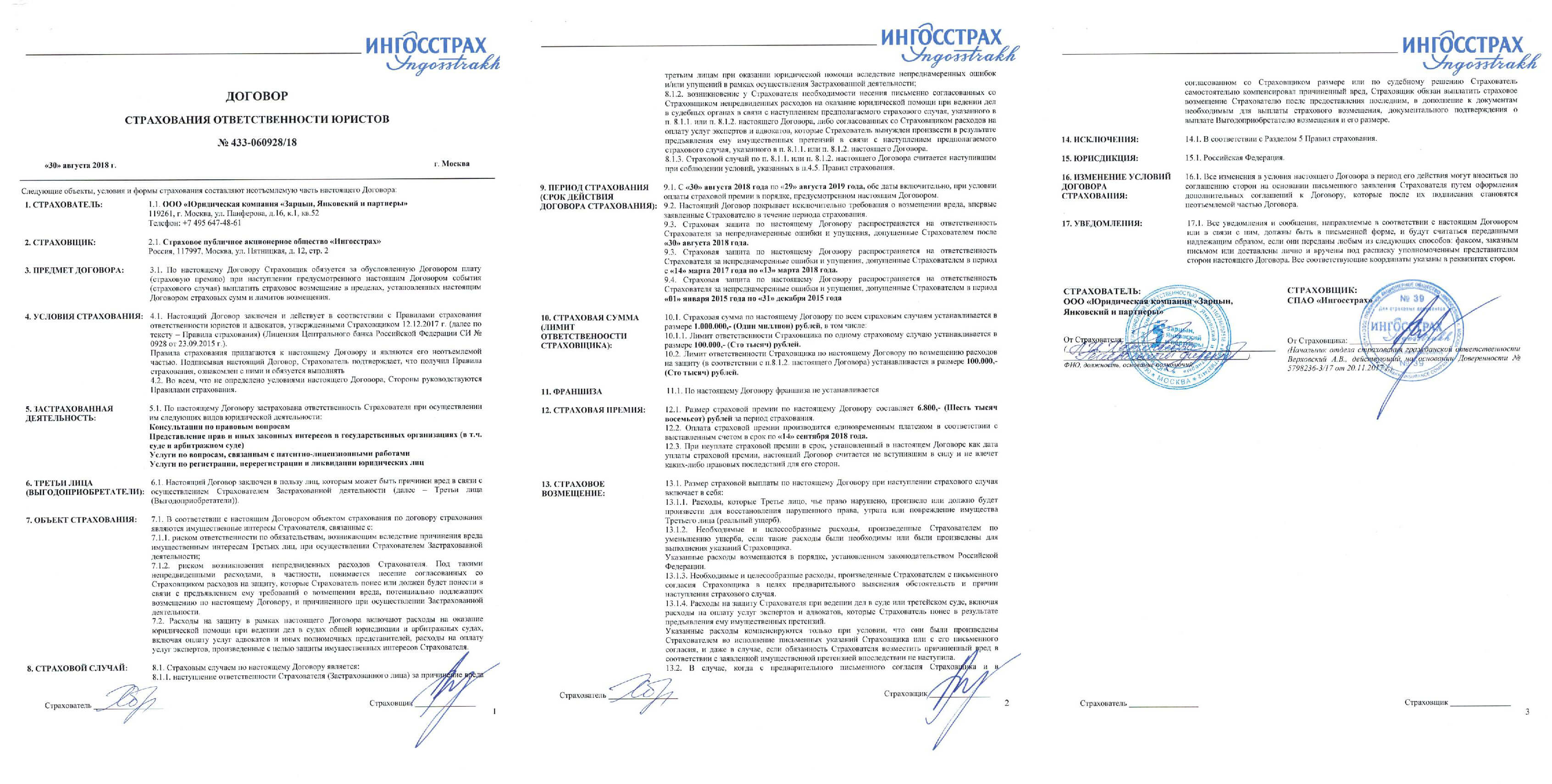

In Russian law, agreements between participants in a legal entity - “corporate contracts” - are relatively new, they appeared in 2008. Since then, thanks to IIDF and other lobbyists, the list of acceptable conditions for corporate contracts has been greatly expanded. Therefore, now theoretically one can set forth almost anything in the corporate contract. But it's doubtful that the court will understand the sophisticated wording of contracts with a huge amount of analytical stuff:

IIDF typical document

If a startup operates as a joint stock company, then, in addition to the corporate agreement, special preferred shares can be used. From a legal point of view, owning special shares that guarantee your rights looks safer than participating in a corporate contract, although ultimately everything depends on the presence or absence of correct judicial practice.

Priorities and preferences

Let me start with the right, which is provided by law, and is only specified in corporate contracts. This is a preemptive right to purchase a share. For example, in an LLC, if one of the participants wants to sell his share to someone “outside”, he must first present the same offer to the other members of the Company. LLC is a “low key” form of a legal entity with a stable list of participants; it is poorly fit for serious corporate conflicts.

However, there are several bugs in the law. So, by law, a share cannot be sold, but it is not forbidden to exchange it for something. For example, if I have a stake in an LLC and I change it to a land plot, then other participants will not be able to physically exercise their preemptive right, even given the opportunity. Simply because they don't have the land plot. There is also a way to severely limit the share without formally selling it, for example, to contribute to the capital of another company or mortgage. And if, say, one of the participants gets the right to redeem my share, he will have to tinker with it.

In order to avoid these and other difficulties, a corporate contract may provide for a ban on the pledge of shares without the consent of the other participants. Also in addition to the law, it can be established that barter, donation and other methods of transferring a share are equivalent to selling it.

Drag- and Tag-along Powers

Standard terms in corporate agreements with venture capital investors are “Drag” and “Tag” (“dragging along” and “tagging along” a share).

The drag-along, or the right to demand a joint sale, gives a large share buyer the right to increase their share to 100%, demanding that all participants sell their own. Thus, if the main participants of the startup decide to sell their shares to a large player, small (minority shareholders) will not be able to throw sand in their wheels.

Tag-along, or the right to join the transaction, allows you to sell your share along with the share of another participant. If one participant has agreed to profitably sell his share "outside", then the rest will be able to join him at the same price. As a result, no one can sell their share at more profitable terms than others, since other participants will immediately join the transaction.

Tag condition is also useful for minority shareholders. Their shares are not particularly interesting for anyone, since they are too small, and without the right to follow, minority shareholders risk getting stuck with their own interest up to an IPO.

Liquidation preference

The investor tries to guarantee contribution return in all possible ways. He can make his contribution as a loan in order to be the first to appear in the line of creditors in case something happens (shareholders of the company are the last to receive the compensation). But there is an easier way. Joint stock companies have preferred shares whose owners receive priority compensation. Moreover, compensation for such shares can be tied not only to liquidation or bankruptcy, but also to many other events (the sale of the company, for example).

Possession of preferred shares does not belittle the rights of the investor as one of the shareholders. after all the reimbursements, he will still receive his share, according to the principle “we use up yours first, and then each one is on his own”.

Privileges on shares are set forth in the charter. In addition to monetary compensation, the right to vote or to veto individual issues can be established for their owners. This gives additional guarantees. A corporate contract is one thing, but the provisions of the charter, which cannot be circumvented at any cost, is different. However, liquidation privileges can be prescribed through a corporate agreement if there are no shares (for example, in case of an LLC), although this is clearly a “crutch” option compared to a joint stock company.

Author: Roman Yankovskiy